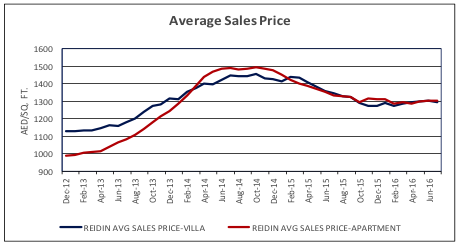

Sales Price Movement

The sales price performance for July 2016 saw a decline for both villas and apartments.

According to REIDIN, the average sales price for apartments dropped in July 2016 by 0.2% MoM and 2.4% YoY to AED 1,302 per square feet. When compared to previous peak of October 2014 (AED 1,495 per sq. ft.), apartment price is 12.9% below this level. For Dubai-Villa in July 2016, the sales price has declined by 0.6% MoM and 3.9% YoY to AED 1,295 per square feet. Compared to previous peak price of October 2014 (AED 1,455 per sq. ft.), current villa price is 11.0% below this level.

According to REIDIN, the average sales price for apartments dropped in July 2016 by 0.2% MoM and 2.4% YoY to AED 1,302 per square feet. When compared to previous peak of October 2014 (AED 1,495 per sq. ft.), apartment price is 12.9% below this level. For Dubai-Villa in July 2016, the sales price has declined by 0.6% MoM and 3.9% YoY to AED 1,295 per square feet. Compared to previous peak price of October 2014 (AED 1,455 per sq. ft.), current villa price is 11.0% below this level.

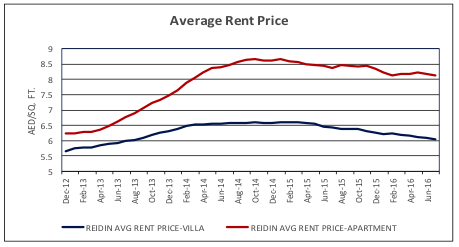

Rent Price Movement

According to REIDIN, the average rent price for apartments decreased in July 2016 by 0.6% MoM and by 3.0% YoY to AED 8.13 per square feet. For Dubai-Villa in July 2016, the rent price has dropped by 0.5% MoM and 5.8% YoY to AED 6.05 per square feet.

According to REIDIN, the average rent price for apartments decreased in July 2016 by 0.6% MoM and by 3.0% YoY to AED 8.13 per square feet. For Dubai-Villa in July 2016, the rent price has dropped by 0.5% MoM and 5.8% YoY to AED 6.05 per square feet.

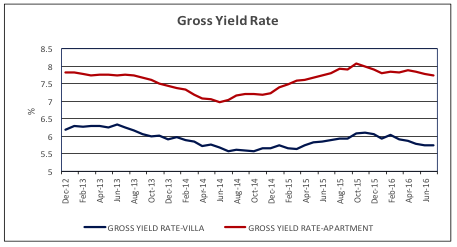

Gross Yield

The Gross Yield for Dubai apartments according to REIDIN depicted a slight decline in July 2016. As of July 2016 REIDIN data, the Gross Yields for apartments and villas are 7.75% and 5.75%, respectively. The same time last year, the Gross Yield for apartments and villas stood at 7.81% and 5.88%, respectively. The historical high for apartments was 9.47% in March 2009 and 7.05% for villas in December 2010.

The Gross Yield for Dubai apartments according to REIDIN depicted a slight decline in July 2016. As of July 2016 REIDIN data, the Gross Yields for apartments and villas are 7.75% and 5.75%, respectively. The same time last year, the Gross Yield for apartments and villas stood at 7.81% and 5.88%, respectively. The historical high for apartments was 9.47% in March 2009 and 7.05% for villas in December 2010.

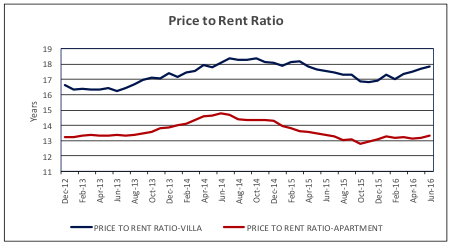

Price to Rent Ratio

The Price to Rent ratios (PRR) for Dubai apartments witnessed a minor increase in July 2016. The PRR for villas stand at 17.78 years as compared to 16.92 years at the end of 2015. Likewise, the PRR for apartments comes to 13.35 years as against 13.08 years at December 2015.

The Price to Rent ratios (PRR) for Dubai apartments witnessed a minor increase in July 2016. The PRR for villas stand at 17.78 years as compared to 16.92 years at the end of 2015. Likewise, the PRR for apartments comes to 13.35 years as against 13.08 years at December 2015.

Based on the PRR trend, Dubai villas still appear slightly better for renting than purchasing. On the other hand, the opposite is true for Dubai apartments, as the PRR clearly indicates that it is better to buy than rent despite the recent rise in the multiple.